Life can throw unexpected financial challenges our way, and sometimes you may need quick cash without a steady job to back it up. Thankfully, there are apps that loan you money instantly without a job, offering fast and flexible financial solutions for those in need. Whether you’re dealing with an emergency, a sudden bill, or just need a little extra cash to get by, these apps provide a lifeline when traditional loans or credit cards aren’t an option. In this guide, we’ll explore some of the best apps that loan you money instantly without a job, discuss how they work, and provide tips for using them responsibly.

How Do Apps That Loan You Money Instantly Without a Job Work?

Understanding the Basics

Apps that loan you money instantly without a job are typically short-term lending platforms designed to provide fast cash. Unlike traditional loans that require proof of steady income, these apps often use alternative methods to assess your eligibility, such as your bank account activity, credit history, or side income.

Common Features

- Instant Approval and Disbursement: Many of these apps can approve your loan within minutes and disburse funds almost instantly.

- Flexible Repayment Terms: These apps usually offer flexible repayment schedules that align with your financial situation.

- No Employment Verification Required: As these apps cater to those without a job, they do not require proof of employment or regular income.

Top Apps That Loan You Money Instantly Without a Job

MoneyLion

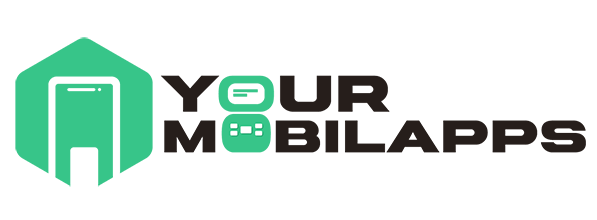

MoneyLion is a financial services app that offers personal loans, cash advances, and financial advice. You can borrow money instantly without needing a job, although you must have a bank account and some form of income, such as freelance work or gig income.

Key Features:

- Credit Builder Loans: Loans designed to help improve your credit score.

- Instant Cash Advances: Get up to $250 instantly deposited into your account.

- No Interest or Fees: There are no interest rates on cash advances, making it a low-cost option for quick cash.

Earnin

Earnin allows users to access their earnings before payday. This app is perfect for those with a steady side gig or freelance income, as it does not require proof of traditional employment.

Key Features:

- Cash Out Up to $500 Per Pay Period: Access up to $100 per day from your future earnings.

- No Fees or Interest: Earnin operates on a tip-based model, allowing users to pay what they think is fair.

- Balance Shield Alerts: Notifications when your bank balance is low, helping you avoid overdraft fees.

Dave

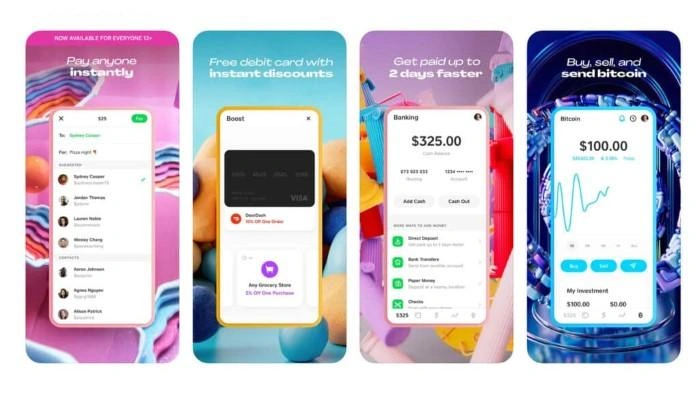

Dave is a financial app that offers cash advances up to $200, along with budgeting tools and alerts to help you avoid overdrafts.

Key Features:

- No Interest: Cash advances are interest-free, though a small subscription fee applies.

- ExtraCash™ Feature: Instant access to funds with no credit check required.

- Side Hustle Finder: Helps users find side jobs to supplement their income.

Brigit

Brigit offers instant cash advances up to $250, with no credit check required. The app also provides budgeting tools and financial tips.

Key Features:

- Automatic Cash Advances: Set up automatic advances when your balance is low.

- No Late Fees or Interest: Brigit does not charge any hidden fees or interest rates.

- Credit Monitoring: Keep track of your credit score and receive personalized tips for improvement.

Chime

Chime offers a “SpotMe” feature, which allows users to overdraft their account up to $200 without fees. While Chime requires a linked bank account and some form of income, it does not require a traditional job.

Key Features:

- Fee-Free Overdraft: Overdraft up to $200 without fees using the SpotMe feature.

- Early Direct Deposit: Access your paycheck up to two days early.

- No Minimum Balance Requirements: Chime accounts are free to maintain, with no minimum balance required.

How to Use Apps That Loan You Money Instantly Without a Job

Understanding Your Eligibility

Each app has different eligibility requirements. While these apps do not require traditional employment, they often require some form of regular income, such as freelance work, gig economy jobs, or government benefits.

Tips for Using These Apps Responsibly

- Borrow Only What You Need: Since these are short-term loans, borrowing only what you need will help you manage repayments more easily.

- Understand the Fees: While many of these apps do not charge interest, they may have subscription fees, tips, or other charges. Be aware of all costs involved.

- Plan for Repayment: Have a clear plan for how you will repay the loan to avoid falling into a cycle of debt.

Comparing Top Apps That Loan You Money Instantly Without a Job

| App Name | Max Loan Amount | Interest/Fees | Requirements | Unique Feature |

| MoneyLion | Up to $250 | No interest on advances | Bank account, some income | Credit Builder Loans |

| Earnin | Up to $500 per pay period | Tip-based | Regular income, bank account | No fees or interest |

| Dave | Up to $200 | Subscription fee | Linked bank account | Side Hustle Finder |

| Brigit | Up to $250 | No fees | Linked bank account | Automatic cash advances |

| Chime | Overdraft up to $200 | No fees | Chime account, regular income | SpotMe fee-free overdraft |

Advantages and Disadvantages of Using These Apps

Advantages

- Quick Access to Cash: Most apps provide instant access to funds, making them ideal for emergencies.

- No Job Requirement: These apps cater to individuals without traditional employment, offering flexibility.

- Minimal Fees: Many of these apps do not charge interest, relying instead on optional tips or subscription fees.

Disadvantages

- Limited Loan Amounts: These apps typically offer smaller loan amounts, which may not be sufficient for larger expenses.

- Potential for Overdraft Fees: If not managed carefully, using these apps could lead to overdraft fees if funds are not replenished in time.

- Short Repayment Terms: Loans are often due on your next payday or within a few weeks, which can be challenging if you’re not careful with your finances.

FAQs About Apps That Loan You Money Instantly Without a Job

Can I use these apps without a steady income?

While these apps do not require a traditional job, most require some form of income, such as gig work, freelance jobs, or government benefits.

Do these apps check my credit score?

Most apps that loan you money instantly without a job do not perform credit checks, making them accessible for those with poor credit.

How quickly can I get the money?

Funds are typically available within minutes to a few hours, depending on the app and your bank.

Are there any hidden fees?

While many apps promote no interest or fees, it’s essential to read the terms carefully to understand any subscription costs or optional tips.

What happens if I can’t repay the loan on time?

If you cannot repay the loan on time, contact the app’s customer service to discuss possible extensions or alternative repayment plans. Some apps may charge additional fees for late payments.

Related Post:

How to Close Apps on iPhone 13: A Complete Guide

How to Uninstall Apps on iPhone: A Step-by-Step Guide

Apps to Make Friends: Discover the Best Platforms to Connect and Socialize

Apps that loan you money instantly without a job provide a valuable resource for those needing quick cash with flexible requirements. Whether you’re facing an emergency or simply need a financial bridge, these apps offer a convenient solution without the hassle of traditional loans. However, it’s crucial to use these services responsibly to avoid falling into a cycle of debt. By understanding how these apps work and knowing your options, you can make informed decisions that best suit your financial needs.